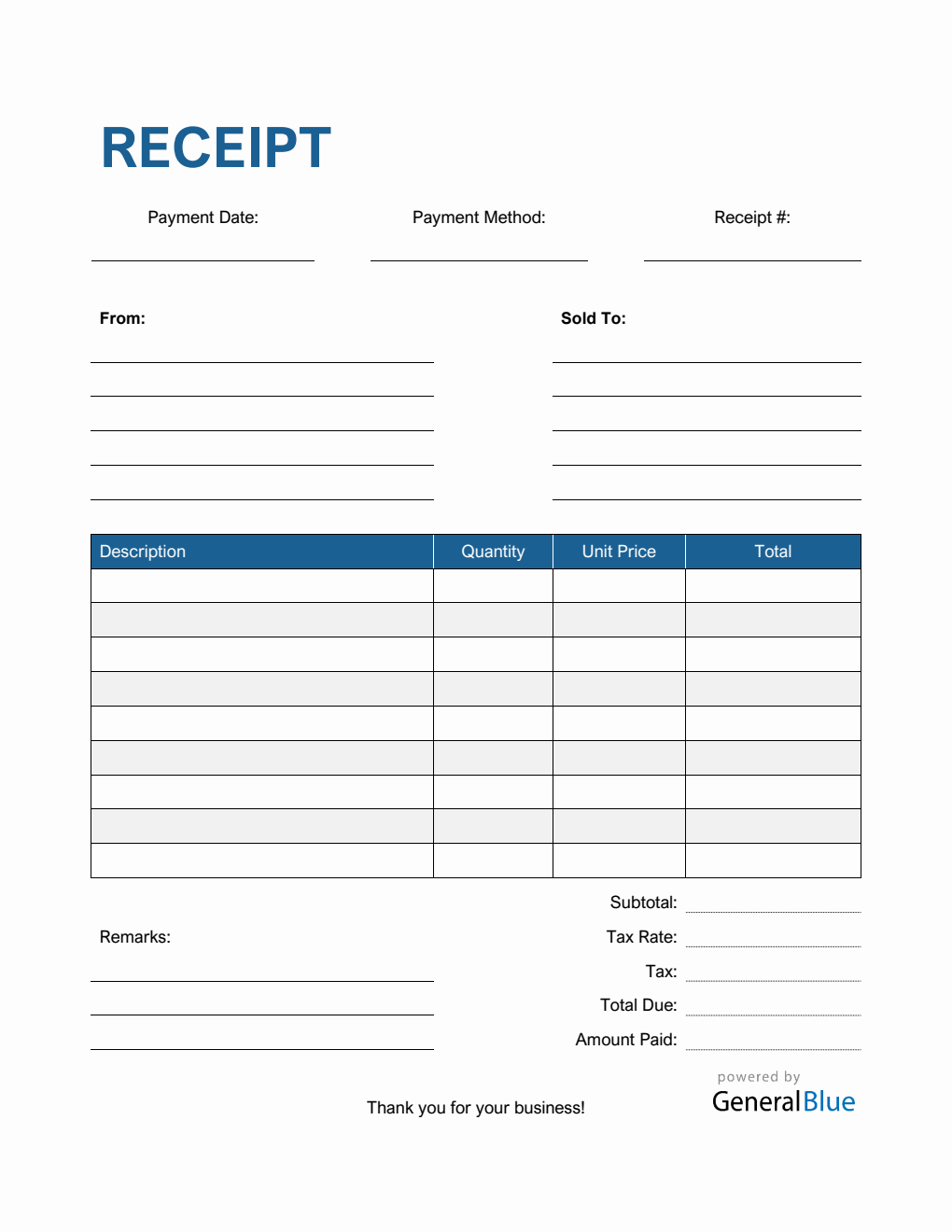

Blank Receipt Template in Excel (Striped)

Free blank receipt template in Excel format. It is printable, editable, downloadable, and free to use. This template is in Striped design.

Receipts are important documents which represent the proof of transaction between two parties. If you’re looking for a professional receipt template to use, you’ve come to the right page.

General Blue provides free receipt templates which you can use when dealing with various business transactions. All receipt forms featured here are free to use, edit, print, or download.

This blank receipt form in Striped design is one of the best receipt templates provided in this page. It keeps records of your customer’s payment information. It’s available in multiple formats and themes, giving you options to select your preferred design.

To use, just fill out details on the sections provided. This printable blank receipt has sections for the payment date, payment method, receipt #, where the receipt came from, bill-to address, description, quantity, unit price, total, subtotal, tax rate, tax, total due, amount paid, and remarks (if there’s any).

Moreover, the blank receipt excel has built-in formulas, allowing the template to automatically calculate the total amount for all goods or services sold.

Instructions:

Fill out the payment date, payment method, and receipt #. This is indicated at the top section of the receipt template. Here, you need to indicate the date when the payment was made, the receipt #, and the payment method utilized, e.g., cash, credit card, or others.

Enter your company information. Enter your name (or company name) and business address in this section. It includes the street address, city, state, zip code, and phone number.

Enter the sold-to information. Enter the billing address of the person or company whom you have sold the goods/services to. The bill-to information includes the name (or company name) of your client, their address, city, state, zip code, and phone number.

List all the goods/services sold to your client. Under the description column, list all the goods/services sold to your client or customer. Each item listed should have a corresponding quantity and unit price entered on the same row.

Indicate the quantity and unit price for each listed item. After listing down all the goods/services sold, you should enter its corresponding quantity and unit price on the same row. Once these details are entered, the total, subtotal, and total due should autogenerate calculations.

Enter the tax rate. Enter the tax rate (%) on the section provided. Once tax rate is entered, actual dollar amount of tax should be displayed under the tax section. The amount generated will be automatically added in the total due, along with the subtotal.

Indicate the total amount paid. Under the amount paid section, indicate the total amount paid by your client with reference to the goods or services purchased.

Add remarks if there’s any. You may specify the running balance or other notes for the recipient in this section.

You might also like:

Apartment Rent Receipt Template in Word

Construction Invoice Template in Word (Basic)