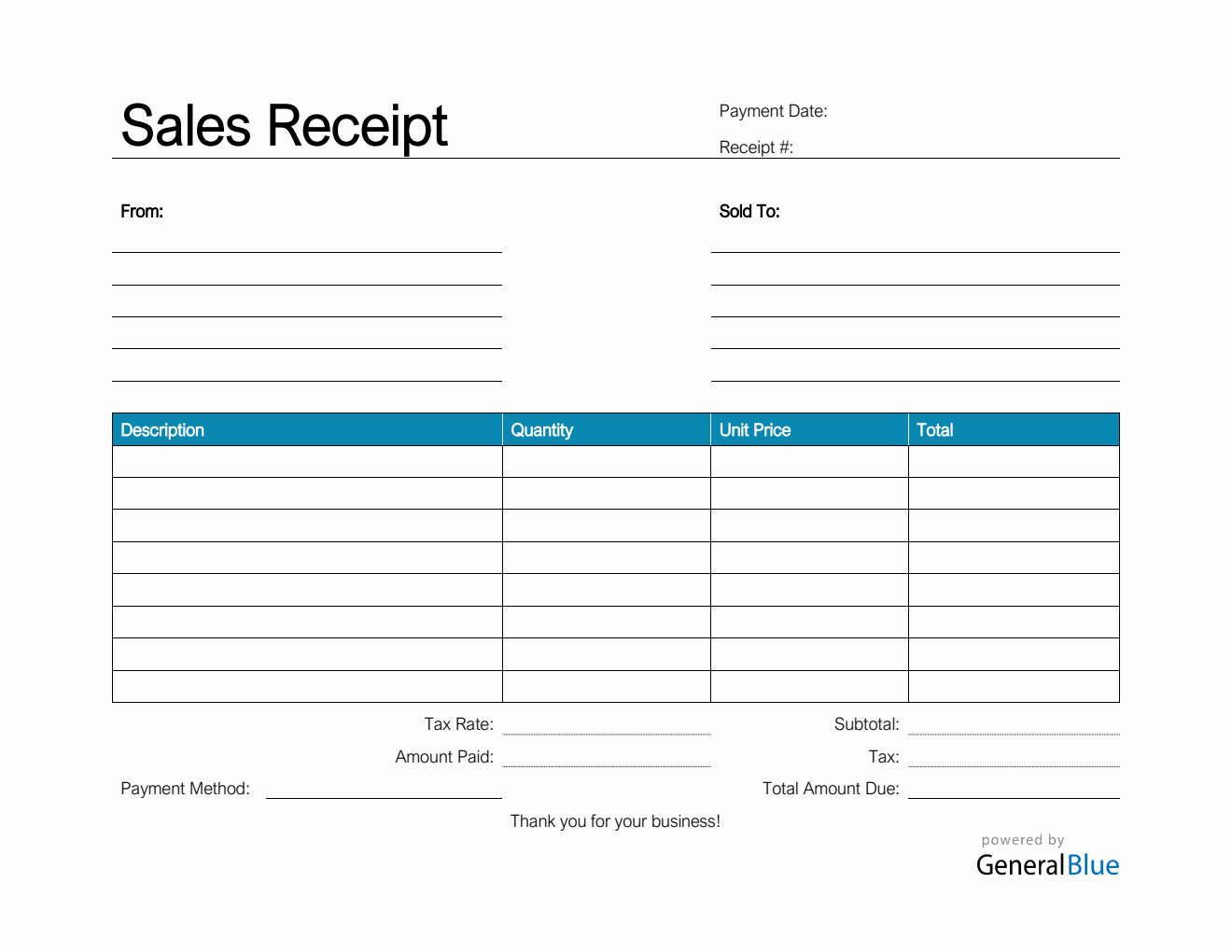

Sales Receipt Template in Excel (Simple)

This Simple sales receipt template can be used to provide detailed payment information to your customers. It’s printable and downloadable in Excel.

Download this Simple receipt template Excel for free. It provides detailed payment information to your customers, at the same time, it can help track your business’s sales and revenue during a certain period.

Sections featured in this receipt form include the payment date, receipt #, where the receipt came from, sold-to information, description, quantity, unit price, total, subtotal, tax rate, tax, total amount due, and amount paid. A section for the payment method is also provided at the lowermost left corner of the receipt template, thus, you can specify the payment method utilized when doing the transaction.

If you want to create your own sales receipt template, you can use this receipt sample as reference. To use, refer to the instructions provided below.

This printable sales receipt is also designed with formulas and has easy to use features. You can use it as originally designed or redesign it, if preferred.

Instructions:

Fill out the payment date and receipt #. This is indicated at the top section of the receipt template. Here, you need to indicate the date when the payment was made as well as the receipt #.

Enter your company information. Enter your name (or company name) and business address in this section. It includes the street address, city, state, zip code, and phone number.

Enter the sold-to information. Enter the company name and billing address of the person or company whom you have sold the goods/services to. The sold-to information includes the name (or company name) of your client, their address, city, state, zip code, and phone number.

List all the goods/services sold to your client. Under the description column, list all the goods/services sold to your client or customer. Each item listed should have a corresponding quantity and unit price entered on the same row.

Indicate the quantity and unit price for each listed item. After listing down all the goods/services sold, you should enter its corresponding quantity and unit price on the same row. Once these details are entered, the total, subtotal, and total amount due should autogenerate calculations.

Enter the tax rate. Enter the tax rate (%) on the section provided. Once tax rate is entered, actual dollar amount of tax should be displayed under the tax section. The amount generated will be automatically added in the total due, along with the subtotal.

Indicate the total amount paid. Under the amount paid section, indicate the total amount paid by your client with reference to the goods or services purchased.

Add the payment method. At the lowermost part of the template, specify the payment method used when doing the transaction. For example, goods/services purchased are paid through cash, credit card, or others.

You might also like:

Printable Receipt Template in Word (Basic)

Simple Receipt Template in Word (Blue)