Sales Invoice Template in Excel (Colorful)

The Sales Invoice can be downloaded in Excel format. It’s editable, printable, and free to use. This template is also available in Colorful design.

This free sales invoice template excel can be used for tracking products/services purchased by your clients or customers. It also tracks how much money they owe your business.

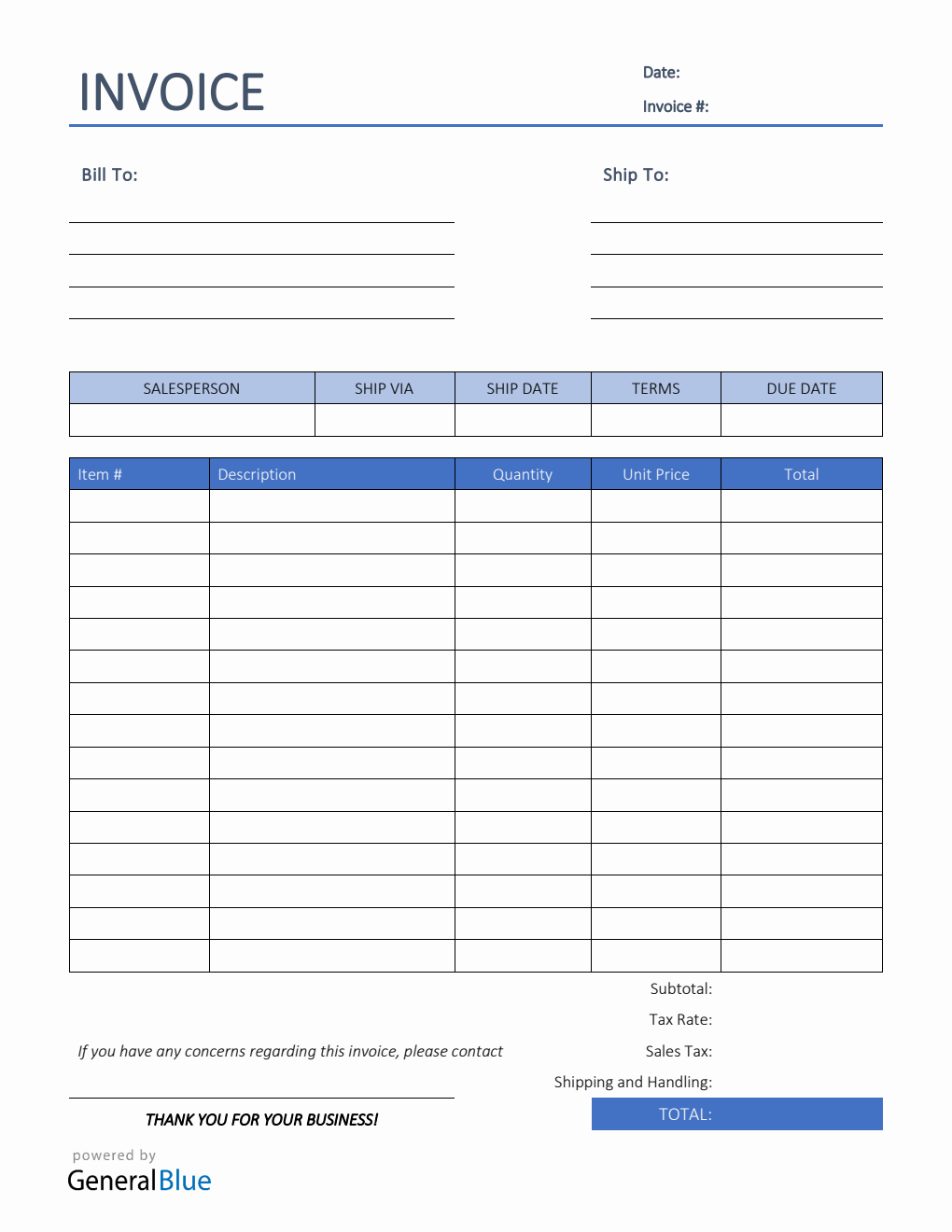

The template features various sections, allowing you to view important details necessary in a sales invoice. The topmost part of this blank sales invoice includes sections for the date, invoice #, bill-to address, ship to address, salesperson, ship via, ship date, payment terms, and due date.

A separate table is also provided to highlight the most important details of the invoice. It includes sections for the item #, description, quantity, unit price, total, subtotal, tax rate, sales tax, and shipping and handling. Moreover, the lowermost part of this sales bill displays a field where you can enter your business contact details just in case there are concerns regarding the invoice. It requires your name (or company name), phone number, and email.

Designed with formulas, all sections needing calculations should auto-calculate. Meaning, there’s no need for you to perform any manual calculations as this template autogenerates calculations once figures are entered. Although sections with built-in formulas can’t be edited, the rest of the template are mostly customizable. With simple features, you can easily edit or customize the template. It’s a sample sales invoice format, so you can also redesign it. Additionally, you can edit the labels/headings provided and replace it with something else which better suits your needs.

Download and print this printable sales invoice anytime. It’s available in Colorful design. You can download as many invoice templates as you want.

Instructions:

Fill out the date and invoice number. This is indicated at the top section of the invoice template. Here, you need to indicate the date when the invoice is created as well as the invoice number for your client. The invoice number usually starts with 1 and increments over time. If you have a long-term contract with your client, it is an essential part of your invoice as it helps in tracking all invoices.

Enter the bill-to information. Enter the billing address of the person or company whom you have sold the goods/services to. The bill-to information includes the name (or company name) of your client, their address, city, state, zip code, and phone number.

Enter the ship to information. Enter the shipping address of the person or company whom you have sold the goods/services to. The ship to information includes the name (or company name) of your client, their address, city, state, zip code, and phone number.

Enter the name of the salesperson, shipment information, and payment terms. Enter the name of the salesperson along with the carrier, shipment date, payment terms, and invoice due date on the sections provided. For the payment terms, just enter the agreed payment terms between you and your client. Most common payment terms are Net 30 or Net 15. Net 30 means your client has 30 days to complete the payment, and 15 days for Net 15.

List the item # along with all goods/services sold to your client. Under the description column, list all the goods/services sold to your client or customer, along with the item number. Each item listed should have a corresponding quantity and unit price entered on the same row.

Input the quantity and unit price for each item listed. After listing down all the goods/services sold, you should enter its corresponding quantity and unit price on the same row. Once these details are entered, sections for the total, subtotal, and invoice total should auto-calculate.

Enter tax rate as well as the shipping and handling charges. Enter shipping and handling charges along with the tax rate on the sections provided. Once tax rate is entered, the actual dollar amount of the sales tax should be auto calculated. The amount generated will be automatically added in the invoice total, along with the subtotal and shipping charges.

Enter your business contact information. The lowermost part of this invoice displays a field where you can enter your business contact details just in case there are concerns regarding the invoice. Here, you should enter your name (or company name), phone number, and email.

You might also like:

Printable Receipt Template in Word (Basic)

Bill Of Sale Invoice in Word (Colorful)